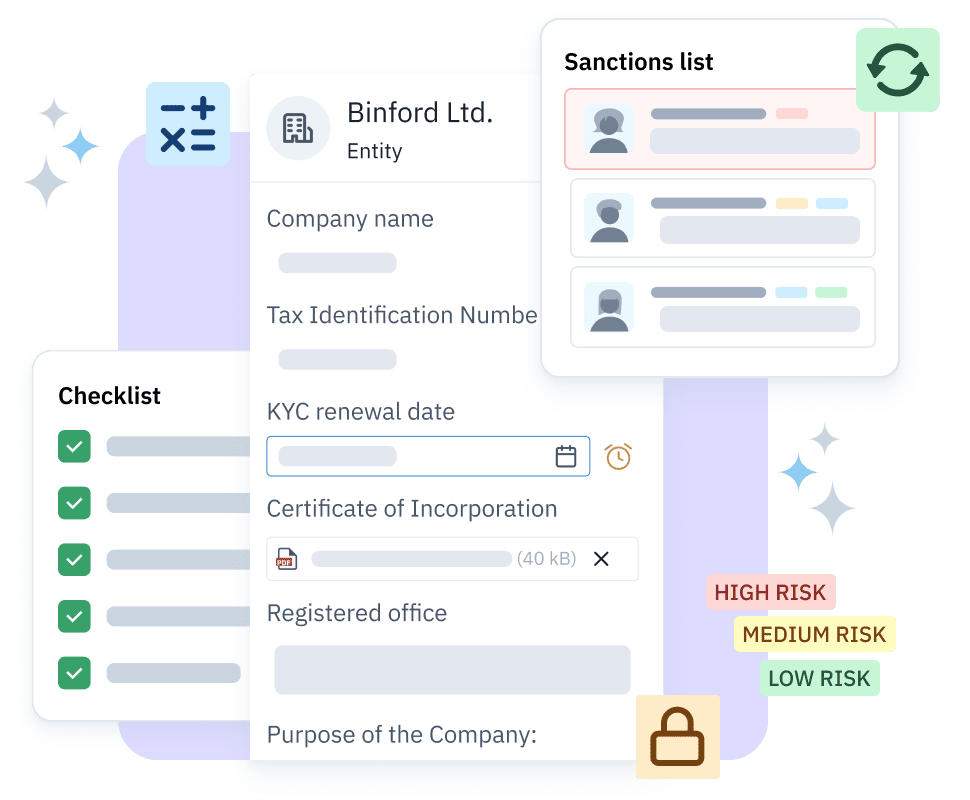

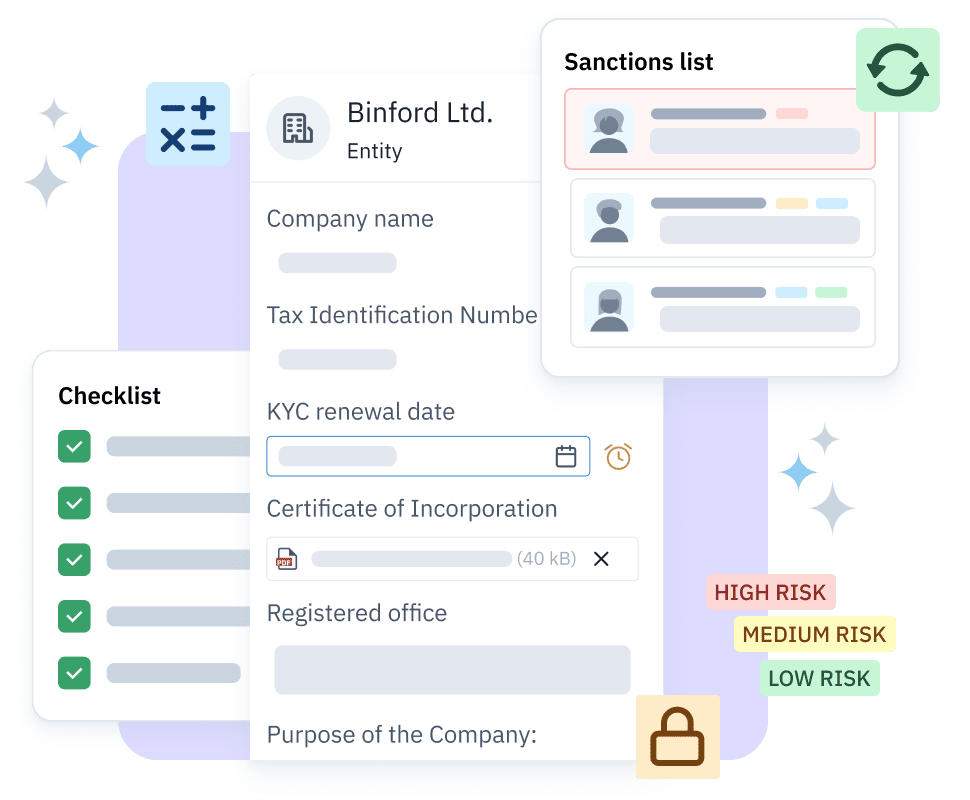

Optimize your AML compliance to drive growth and build trust

Meet all AML requirements end-to-end. Build a secure, scalable business while offering a user-friendly onboarding.

Meet all AML requirements end-to-end. Build a secure, scalable business while offering a user-friendly onboarding.