Last updated on

Financial KPIs Reporting

Designed for Finance, Operations, and General Management

Created by Alex Romera on Parallel

This template includes

- 27 question fields

- Possibility to enable eSignature

- Personalized message

About this template

Are you the CEO or CFO of a company? Do you belong to a board of directors? With this template you can automate the simultaneous collection of the main economic-financial indicators of a company, in a quick and agile way, without meetings or email chains.

Having to request data from the different departments of your company can be a headache. This template allows the heads of different departments to simultaneously complete the data of their corresponding economic-financial KPIs.

As a result, you will speed up the process and provide executives, managers or members of the board of directors with more immediate access to the main business performance indicators on a regular basis (monthly, quarterly, etc.).

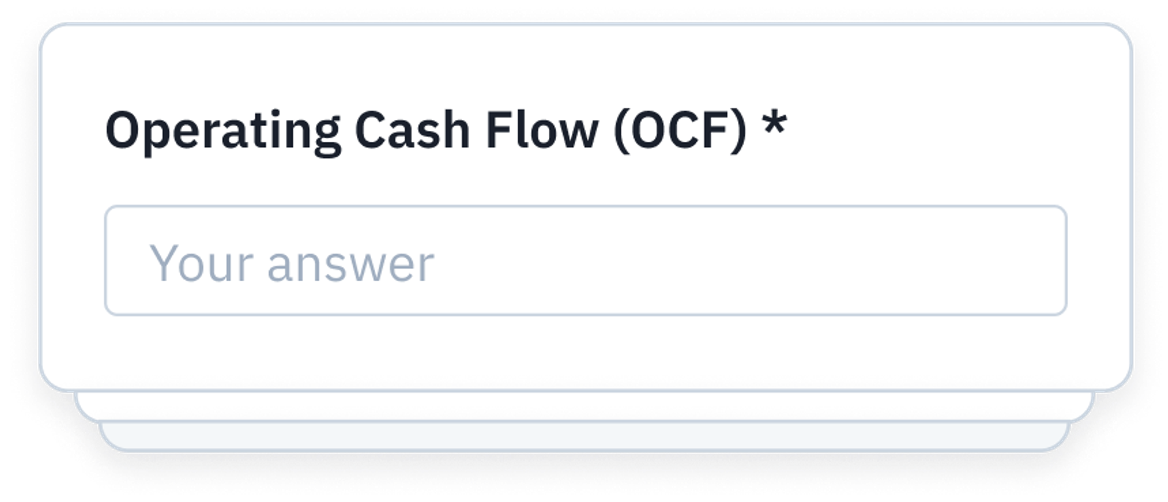

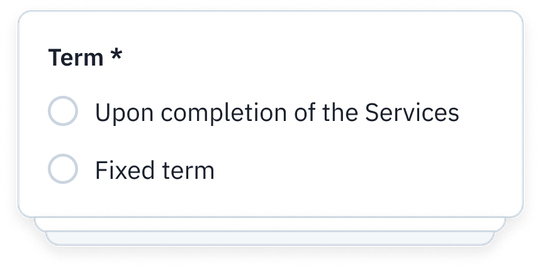

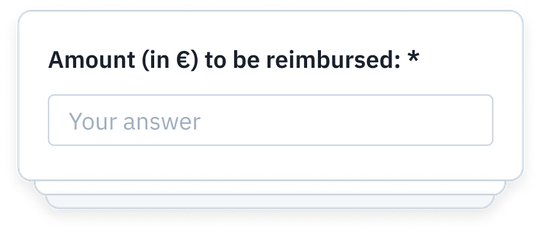

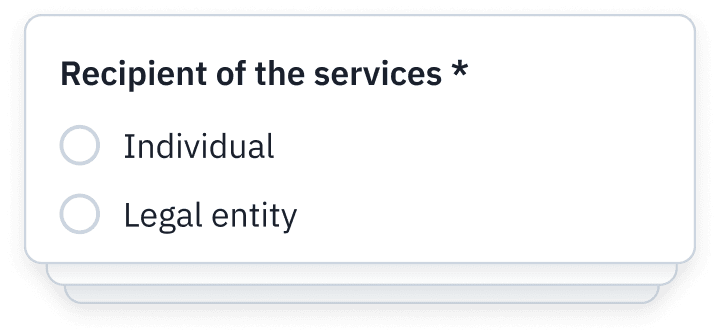

This template contains a checklist with financial ratios of liquidity, management or activity, leverage and profitability.

If you want to add or omit any of these indicators, you can edit the template to better adapt it to the financial information of most interest to your company.

In addition, you can create a public link to this template so that the different departments can provide the information on a regular basis without having to ask for it, they will simply access the link and fill in the relevant information, initiating the process when they need it.

Information list

Other similar templates

Created by Blanca Gallego on Parallel

Created by Alex Romera on Parallel

Created by Derek Lou on Parallel